SERVICEPERSONS AND VETERANS

Members of Illinois National Guard units ordered to ready for deployment in the Middle East. Since the commencement of the Global War on Terror in September 2001, the armed forces of the United States have maintained a heavy, continuous presence in the Middle East. This has included deployments and combat in Afghanistan, Bahrain, Iraq, Jordan, Saudi Arabia, Syria, Turkey, Yemen, and the waters surrounding these countries. At the beginning of this week, more than 300 Illinois National Guard members were preparing for deployment in Operation Spartan Shield. The service personnel were reviewed by Major General Rodney Boyd at Wintrust Arena in Chicago on Saturday, January 27.

While in Operation Spartan Shield (OSS), the deployed personnel will be under the umbrella of the U.S. Central Command (USCENTCOM). Operation Spartan Shield is an open-ended deployment operation that, since September 2012, has rotated U.S. service personnel into and out of the Middle East. All the personnel who are assigned for Spartan Shield deployment are members of personnel units that have undergone specialty training for the duties they will be asked to perform while deployed. National Guard units assigned to Spartan Shield deployment tasks typically perform duties related to infrastructure support and logistics.

BUDGET

House Republican leaders discuss budget priorities. Last week I held a press conference alongside the Republican Budgeteers in my Capitol office. As the General Assembly begins a new legislative session and looks ahead to the Governor’s budget address in two weeks, we wanted to set the stage for what we expect to be included in the upcoming FY25 budget proposal. Our priorities include:

- Holding the majority party accountable to spending

- No New Taxes – Illinois voters rejected a graduated income tax in 2020. We need to provide meaningful tax relief to Illinois residents.

- Tackling the State’s $141 billion pension debt

- Fixing state agency mismanagement and disfunction

- Meeting our prior fiscal obligations

- Real Ethics Reform – The federal corruption trials and convictions of the ComEd Four, former Madigan Chief of Staff Tim Mapes, former Chicago Alderman Ed Burke, and the upcoming trial of former House Speaker Michael J. Madigan should instill action in the majority party to work with Republicans on meaningful ethics reform proposals.

- Properly funding education via the evidence-based model

- Prioritizing state services for Illinois citizens

House Republicans want to be part of the solution! We have reached out to the Governor, Senate President Harmon, and Speaker Welch to again ask them to work with us. But to that tune, it takes two to negotiate. And most importantly, we must negotiate in good faith. That requires trust to be rebuilt, where it has been broken by Speaker Welch in last year’s budget process.

Norine Hammond, Deputy Republican Leader and chief budgeteer for the House Republicans, pointed out that just last week, Republicans joined with Democratic colleagues in bipartisan support of a plan to protect family farms by changing Illinois’ burdensome estate tax. This effort underscores that we can work together across the aisle to advance meaningful improvements to our tax and budgetary policies.

“I am hopeful that Republicans and Democrats will be able to work together to pass a budget that protects Illinois taxpayers, properly funds shared priorities, and makes real reforms to improve our economy,” said Leader Hammond.

Amy Elik, Assistant Republican Leader and deputy budgeteer, discussed her legislation to provide tax relief to Illinois families.

“House Bill 4998 will provide tax relief to every taxpayer in the state by removing the pause in the inflationary component of the standard exemption, which was included in the revenue omnibus last year,” said Rep. Elik. “Our legislative proposal seeks to restore the cost-of-living adjustment and provide taxpayers some relief on their tax bills next year.”

CGFA: Income tax receipts down in January. The numbers, which reflect State tax revenue intake, were published in the “Monthly Briefing” published by the General Assembly’s Commission on Government Forecasting and Accountability (CGFA) as tracking of State revenues in January 2024. Although the U.S. economy continues to be strong nationwide, payment of income tax to the Illinois Department of Revenue (IDOR) dropped significantly in January 2024. Relative to the prior year, personal income taxes paid to IDOR were down $52 million from the previous year, and corporate income tax payments were down $15 million, creating a total income tax shortfall of $67 million.

Although State sales tax receipts rose $16 million during the same period, the income tax shortfall was decisive in producing overall negative revenue trend numbers for January. Across all general funds tax lines, State of Illinois January 2024 revenues were down $22 million from the year-earlier month. This cash flow number marks what could be a significant negative turnaround from the generally positive numbers chalked up by IDOR during the first half of FY24. During this period, Illinois income tax revenues and overall tax revenues posted a series of numbers that were able to keep up (just barely) with the swelling spend rates of the State as authorized by the Democrats’ FY24 State of Illinois Budget.

BUDGET – HEALTHCARE FOR UNDOCUMENTED

Massive costs continue for healthcare benefits program for undocumented immigrants. As part of the Democrat-passed FY24 State Budget, $550 million in taxpayer funding was set aside to provide subsidized health care for undocumented immigrant adults. Called the “Healthcare Benefits for Immigrant Adults” (HBIA) and “Healthcare Benefits for Immigrant Seniors” (HBIS) programs, the programs make Medicaid-like payments to health care providers (overwhelmingly hospitals and hospital-affiliated clinics) for the care they provide to undocumented immigrant adults who are not eligible for Medicaid.

Current testimony, presented to the General Assembly’s Joint Committee on Administrative Rules (JCAR), indicates that the $550 million appropriated for these programs is falling far short of the required sum. Current law allows hospitals to bill the State for this care, and the State must pay the bills. Calling the current situation an “emergency,” the Illinois Department of Healthcare and Family Services (HFS) has published an emergency rule that will deduct a set of co-payments from the funds they are required to pay healthcare providers when they are billed. The hospitals will be expected, in turn, to pass these co-payments on to the affected patients.

As of February 1, 2024, new co-pays and co-insurance for existing enrollees in the Health Benefits for Immigrant Seniors (HBIS) and Health Benefits for Immigrant Adults (HBIA) programs went into effect:

- Non-emergency Inpatient hospitalizations: $250 co-payment per stay.

- Non-emergency Hospital Outpatient Services or Ambulatory Surgical Treatment Center: 10% of what HFS would pay the provider. The amount an enrollee can be charged will vary depending on the service and the provider, and enrollees should check with the provider on whether they will need to pay an out-of-pocket cost for a service.

Beginning January 1, 2024, many HBIA and HBIS enrollees have begun receiving services through HealthChoice Illinois, the State of Illinois’ Medicaid Managed Care Program. Previously, services were delivered to HBIA and HBIS enrollees solely via a fee-for-service model. MCO enrollment for HBIA and HBIS customers is taking place in waves, with the last cohort of HBIA and HBIS customers enrolling with an MCO April 1.

While implementing co-pays has the potential to help bring the projected annualized cost down, the likelihood of this happening appears to be small, as it was recently announced that (Cook) CountyCare Health Plans will be the only MCO to not implement the co-pays. This will have a drastic fiscal impact as a large majority of the undocumented immigrants in the HBIA/HBIS program are from Cook County. Additionally, the transitioning of groups from Fee-For-Service to Managed Care is an on-going process, and it is likely that, even with the last group transitioning April 1st, the State won’t see a huge impact before the end of the fiscal year.

Each month, HFS releases updates on enrollment/costs for this program. The most recent report was released on January 9th, and the projected annual cost to provide healthcare benefits to undocumented immigrant adults was still at $773 million, or $223 million over FY24 appropriations.

TAXES

Tax Foundation ranks Illinois 49th of 50 states for business taxes. The consolidated tax rate levied on the income of incorporated businesses in Illinois, 9.5% (7.0% standard corporate income tax plus a 2.5% “personal property replacement” tax) is the second-highest corporate tax rate levied by the 50 states. Only one state, Minnesota, levies a higher income tax rate (9.8%). The corporate tax rankings were published in January by the Washington, D.C.-based Tax Foundation.

Most U.S. states levy either an income tax or a gross receipts tax on the businesses located within state lines. The natural resource-rich states of South Dakota and Wyoming are the only states that levy neither type of broad-based tax on a business’s income, or on the value added within gross receipts of the business. However, many states with state income taxes on business levy these taxes at rates much lower than Illinois. In North Carolina, for example, the business income tax is 2.5%.

Furthermore, the property taxes imposed on business-owned real property by Illinois units of local government are a further heavy burden on the Prairie State’s economy and job creation. In Illinois, our property tax burden is often classified as making Illinois the 49th or 50th among the 50 states in terms of property taxation. To make matters even worse, a significant percentage of Illinois business property is in a jurisdiction – Cook County – which “classifies” property for appraisal purposes, shifting a substantial share of the Cook County property tax burden onto owners and operators of commercial and industrial property.

All the states that neighbor Illinois levy income taxes on business, but their rates are much lower than Illinois. Furthermore, some state income tax codes levy marginal rates which offer a break to smaller businesses. The top business income tax rates charged by Illinois-neighboring states are 7.9% in Wisconsin, 7.1% in Iowa, 4.9% in Indiana, and 4.0% in Missouri. Between 2021 and 2023, all of Illinois’ neighboring states reduced their personal income tax rates, their corporate income tax rates, or both. According to the Illinois Policy Institute, these neighboring states lowered their burdens on their taxpayers by an estimated $13 billion during this period.

TAXES – ESTATE TAX – REFORM

McCombie and House Republicans Back Estate Tax Legislation. The Illinois Farm Bureau unveiled new legislation aimed at improving the Illinois Estate Tax. I have spearheaded efforts throughout my tenure to address this problematic “death” tax, one that has disproportionately hurt family farms but also small businesses and manufacturing in Illinois. Members of my leadership team stood in support of the recently unveiled bipartisan proposal.

For the past seven years, I have worked in the Illinois House of Representatives to address the estate tax–alongside several House Republican members who have pursued ways in which small businesses, farmers, and family businesses could see relief from the punitive nature of the state’s archaic tax system which “re-taxes” assets upon death of the owner.

This past Spring, I provided subject matter testimony in the House Revenue Committee in support of legislation I sponsored to reduce the estate tax and protect family farms. I was joined in the Capitol last March by members of the Farm Bureau and the National Federation of Independent Business who were supportive of my bill and provided key testimony in favor of the measure, which would prevent any double taxation of inherited farms and small businesses.

While I have supported more comprehensive legislation on this issue that has not moved forward, the need for tax relief still ranks as a top priority for House Republicans this legislative session. I have advocated for a fix to the estate tax for a long time, and I take this newly introduced bill as a bipartisan step forward, with the understanding that we must go much further to change Illinois’ reputation as a bad place to do business.

In a press conference last week in Bloomington, at the home office of the Illinois Farm Bureau, House Republican leaders stood with bipartisan lawmakers supporting the new measure. House Bill 4600, named the Family Farms Preservation Act, is designed to protect the heritage of family farmers by updating the Illinois Estate Tax code.

Deputy House Republican Leader Norine Hammond recognized the progress this bill makes to protect family farms in the state, but also noted the need for greater bipartisanship to continue doing more.

“Illinois’ estate tax hurts our farm families. House Republicans have consistently fought to increase the exclusion amount to account for rising farmland values. House Bill 4600 is a bipartisan agreement that will help family farmers pass their farmland on to the next generation, protecting our family farms from being sold off to large corporate or foreign interests. I’m proud to stand with the Illinois Farm Bureau and my colleagues in support of this critically needed change to our tax laws,” said Hammond.

According to State Representative Charlie Meier, “The estate tax has devastated family farms for decades as these farms are often sold to pay the inheritance tax.”

Rep. Meier is not only a farmer but serves as the Republican Spokesperson on the House Agriculture & Conservation Committee. “Improving estate tax exemptions for farmers will help save family farms when the farm is passed down to each generation,” continued Meier. “Family farms treat their farmland like family as it helps provide for their family and produces the crops that help feed the world. Our country has the lowest food costs in the world, thanks to family farms.”

OUTDOOR SPORTS

Grand American trapshooting meet inks deal to extend Sparta, Illinois as host for additional 10 years. The Amateur Trapshooting Association, operator of Grand American, worked with the World Shooting and Recreational Complex prior to this week’s announcement. The compact is expected to keep the Grand American in Randolph County through 2036. The Illinois Department of Natural Resources estimates that the Grand American brings $27.5 million into Southern Illinois every year. This is great news for many around the state, including NW Illinois as many of our youth complete in Sparta!

VALENTINES FOR VETS PROGRAM A SUCCESS

I was pleased to deliver dozens of valentine’s day cards to veterans through my Valentines for Veterans program I launched last month. There were countless handmade cards collected from area students, and it made all the difference in brightening the days of veterans in our community! Thank you to all who helped make this event a success!

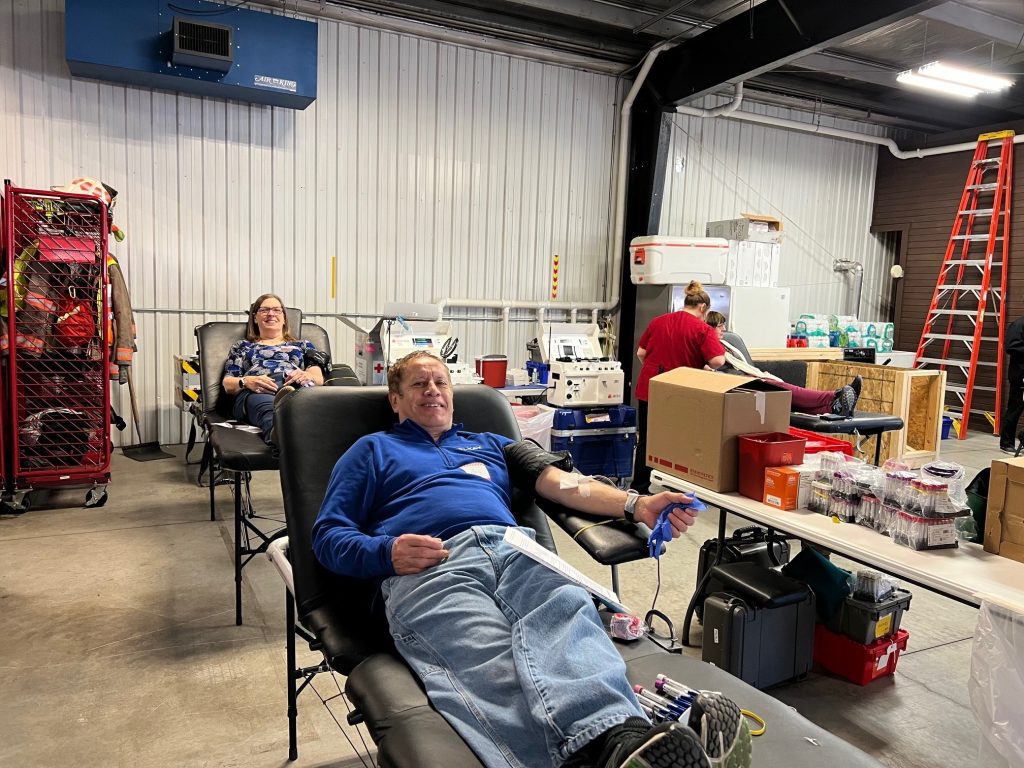

BLOOD DRIVE SAVES LIVES

The blood drive event held in Savanna had a great turn out last week! A special thank you to the American Red Cross, the City of Savanna, and the Savanna Fire Department for helping make this great event happen.

We had 35 people donate blood, which helped boost blood supply and will help save lives! Save the date for the next opportunity to give blood in December…More details to come.