IMMIGRATION

Audit shows Pritzker Administration vastly underestimated the cost of immigrant healthcare program. On Wednesday, the Illinois Auditor General released the results of an audit of the Health Benefits for Immigrant Seniors and Adults programs, which showed that the State of Illinois has already spent over $1.6 billion in taxpayer funds on health benefits for undocumented immigrants.

According to the Auditor General’s report released on February 26, Governor Pritzker’s administration vastly underestimated the actual cost and actual enrollment of the HBIS and HBIA programs.

Regarding the initial cost estimates for all three fiscal years 2021, 2022, and 2023:

- for HBIS (65+) the total estimate was $224.0 million, while the actual total cost was $412.3 million or 84 percent higher;

- for HBIA (55-64) the total estimate was $58.4 million, while the actual total cost was $223.1 million or 282 percent higher; and

- for HBIA (42-54) the total estimate was $68.0 million, while the actual total cost was $262.2 million or 286 percent higher.

The total cost for the HBIS and HBIA programs since inception was just over $1.6 billion (for FY21-FY24). Fiscal Year 2025 has an estimated cost of $629 million, which was not included in the audit, bringing the total estimated cost of the programs to $2.2 billion.

Regarding the estimated number of enrollees, in FY23:

- for HBIS (65+), the initial estimated number of enrollees was 6,700, while the actual number enrolled was 15,831;

- for HBIA (55-64), the initial estimated number of enrollees was 8,000, while the actual number enrolled was 17,024; and

- for HBIA (42-54), the initial estimated number of enrollees was 18,800, while the actual number enrolled was 36,912.

Last week, Governor Pritzker proposed ending the HBIA program for undocumented immigrant adults aged 42-64 in his proposed Fiscal Year 2026 budget. The State of Illinois has already spent nearly $1 billion on health benefits for this age group, with actual costs being 282 to 286 percent higher than the administration’s initial estimates. Gov. Pritzker only proposed eliminating this program for adults aged 42-64, while keeping the HBIS program intact for undocumented immigrants aged 65+.

Background on Health Benefits for Immigrant Seniors and Adults. On November 7, 2023, the Legislative Audit Commission adopted Resolution Number 165, which directed the Office of the Auditor General to conduct a performance audit of the Illinois Department of Healthcare and Family Services’ (HFS) administration of the program of Medicaid services and coverage provided to undocumented immigrants from FY21-FY23.

In 2020, Illinois began to expand healthcare coverage to noncitizen immigrants. The first expansion, the Health Benefits for Immigrant Seniors program (HBIS), began in December 2020, and covered adult seniors 65 years of age and older. The second expansion began in May 2022 and covered immigrant adults between the ages of 55 and 64. The most recent expansion began in July 2022 and covered immigrant adults between the ages of 42 and 54. These two expansions are both part of the Health Benefits for Immigrant Adults program (HBIA).

SB 1298/P.A. 103-102 (FY24 Medicaid Omnibus) included a provision that allowed HFS to implement emergency rules to provide for the expeditious and effective ongoing implementation of HBIA/HBIS. In the following months of 2023, the Pritzker Administration implemented enrollment caps and other cost saving measures.

House Republicans call for end of taxpayer-funded health benefits for illegal immigrants. I released the following statement in response to the Illinois Auditor General’s report on the state run HBIA/HBIS program for undocumented immigrants, which far exceeded enrollment and cost estimates:

“House Republicans warned about the costly expansion of this program when it was first exposed last year. We could not afford it then, and we cannot afford it now. Yet, Democratic leadership forced taxpayers to shoulder the burden of this reckless spending for non-citizens, pushing our state’s finances to the brink.

“Beyond the overwhelming cost, reports of fraud and abuse make it even clearer that this program must end. There is no need to wait until the next fiscal year—immediately shut it down and protect Illinois taxpayers.”

RELIEF FOR WORKING FAMILIES

House Republicans introduce measures to alleviate financial strain on working families. Illinois working families face an unprecedented number of financial hurdles that a group of House Republican legislators want to help them overcome. The lawmakers unveiled a package of bills aimed at providing much needed financial relief for Illinois’ working families.

The Relief for Working Families legislative package contains proposals which encourage entrepreneurship, help tipped employees keep all of their gratuities, and create opportunities for technical skill-building that can lead to high-paying jobs.

“Our Relief for Working Families bill package was crafted in order to reduce the financial burdens placed on middle-class Illinoisans who have had to put up with years of economic uncertainty, incessant tax increases, and overspending,” said Rep. Brad Stephens. “With this bill package, we can provide tangible financial relief for hardworking, taxpaying Illinoisans and begin to reshape our state into a destination not only for families, but for students, small businesses, and licensed professionals.”

Included in the package is Rep. Kyle Moore’s Reducing Barriers to Start Act (HB 1351) which will eliminate many of the startup fees that new businesses face in Illinois, including all first-year business fees relating to licensing or registration. According to the U.S Treasury, small businesses created over 70 percent of net new jobs since 2019 so removing the barriers to entrepreneurship means businesses can get up-and-running more quickly and start creating new jobs.

Education is also a key component of the legislative package. Not only do these bills expand training and employment opportunities for working families, they also address the workforce shortage facing the trades and manufacturing sectors of the economy.

Rep. Mike Coffey’s legislation creates the Reinvest in Future Technical Careers Act (HB 1729) which provides tax credits for those who make authorized contributions to funds that award scholarships to students who attend technical academies. HB 1729 would provide opportunities for those who are not otherwise able to afford the training.

Other proposals that provide educational assistance include HB 1752 sponsored by House Assistant Republican Leader Brad Stephens, which creates an income tax deduction for employers who provide educational assistance for employees. Rep. Kevin Schmidt’s HB 3807 establishes the Illinois Trades Retention and Development Encouragement (ITRADE) grant program to help students gain a degree or certification in the fields related to the trades like electrical, plumbing, masonry, steel working and construction. House Deputy Republican Leader Ryan Spain is also focused on making education more affordable for working families. His HB 3821 doubles the current education expense income tax credit from $750 to $1500 a year.

Many manufacturing companies in Illinois have expressed concern over the shortage of a trained workforce to fill their needs. One of the obstacles has been a need for licensed educators. Rep. Jed Davis HB 1112 opens the door for highly skilled trade workers to become educators, even without a bachelor’s degree, ensuring more experts teaching real-world skills and more opportunities for students to complete their education in manufacturing, engineering, technology or a trade.

Finally, HB 1383 sponsored by Deputy Leader Spain, creates an income tax deduction on Illinois tax returns for gratuities which were included in the tipped-workers federal tax returns. The legislation would help those who rely on gratuities to keep more of their earnings instead of turning them over to the government.

The financial wellbeing of Illinois’ working families is a top priority for House Republicans who will be championing this package of bills throughout the legislative session.

I am a co-sponsor of this package of bills—which is a direct response to the issues that we see and hear about from families across our state. I released the following statement on the Relief for Working Families bills:

“I am proud to stand with my colleagues in fighting for real relief for Illinois’ working families. For too long, hardworking taxpayers have been burdened by high costs, job barriers, and economic uncertainty. This package of bills is about making life more affordable, helping families keep more of their earnings, opening doors for new businesses, and ensuring our workforce is strong for the future. House Republicans are committed to creating opportunities and easing financial strains, and this legislation is a crucial step in that direction.”

House Republicans oppose any attempt to raise taxes on working families and seniors. As legislative hearings and negotiations begin on the Fiscal Year 2026 State Budget, House Republicans have reiterated our opposition to any attempt to raise taxes on working families and seniors. Multiple tax hike proposals have been floated by Illinois Democrats this year, including another progressive income tax increase.

Deputy Minority Leader Norine Hammond, who serves as the chief budgeteer for the House Republicans, criticized Illinois Democrats’ compulsion for excessive spending during session this week. Since 2019, Governor JB Pritzker and the Democratic supermajority have increased spending by more than $15 billion. As budget negotiations get underway, House Republicans will stand with hardworking families against any attempt to increase taxes.

UPCOMING EVENTS

Thank you to everyone who attended my Office Hours events last week in Pecatonica and German Valley. I was happy to meet with several constituents and discuss important legislative issues.

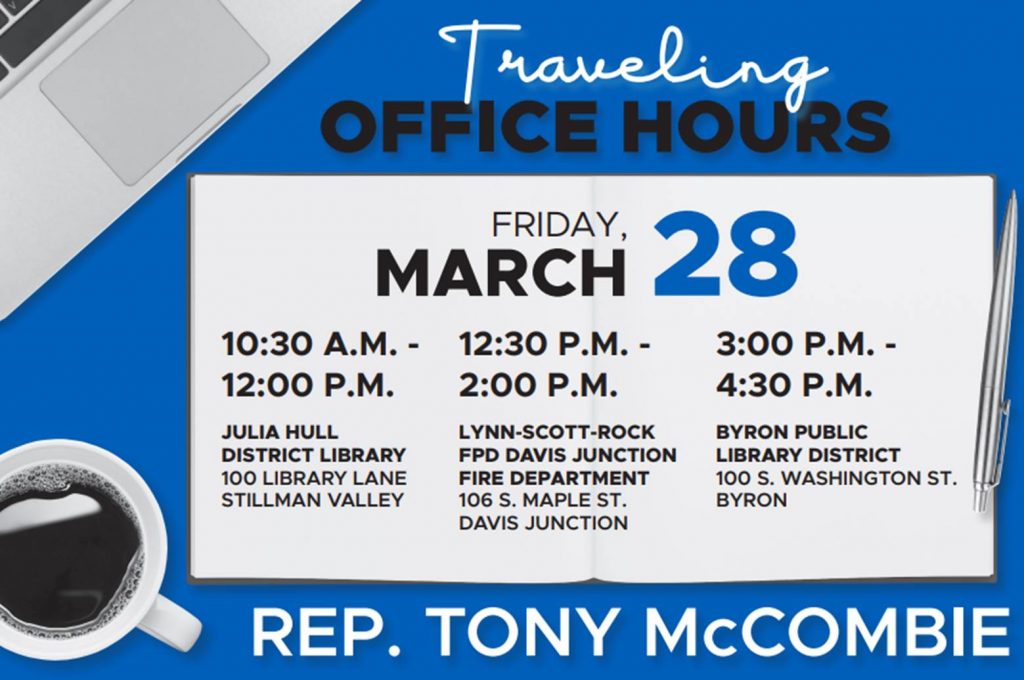

If you could not make it last week, my office will be hosting another round of office hours later this month: save the date for Friday, March 28th! While I will be in the Capitol, my office will be on hand to help you navigate any issues with state agencies, or other legislative questions.

I am excited to announce my annual Spring Photo Contest! This is a great opportunity for residents to get outside, welcome the spring season, and capture the best of northwest Illinois!