BUDGET/TAXES

Get ready for higher taxes: Gov. Pritzker issues splashy executive order to lay foundation for big tax hike

In “Executive Order 2025-05”, published this week, Gov. Pritzker admitted that Illinois’ economy is going downhill, and issued a text that tried to shift blame to the federal government for Illinois’ longstanding budget woes.

The FY26 budget passed by the Democrat supermajority already included over $1 billion in tax increases, fund sweeps, and other budgetary gimmicks, and was still only barely balanced on paper. Democrats supported and the Governor signed this precariously balanced budget despite multi-year, repeated warnings from credit ratings groups and economists that a recession was on the horizon. Ignoring these warnings will have more of an effect on the FY26 budget than any federal action will.

Pritzker’s Executive Order directs certain State agencies to find 4% across-the-board budget reserves without compromising essential operations. These cuts would be made to the FY26 budget enacted by Pritzker’s fellow Democrats. The budget was signed into law by the Governor in June 2025, and by issuing Executive Order 2025-05, the Governor recognizes that his budget did not correctly forecast State revenue. The drafters of the dysfunctional budget had hoped, without evidence, that State revenue would be able to support the record level of spending demanded by big-government advocates.

Left unstated in the Pritzker EO were facts and data, generated since Pritzker took office in 2019, that show that Illinois’ economy has continuously underperformed the overall U.S. economy, as well as the economies of our neighboring Midwestern states. Throughout this six-year period, Illinois has posted jobless rates that have been higher than the national rate. For example, Illinois’ August 2025 unemployment rate of 4.4% was higher than the national rate of 4.3%, and higher than the rates of neighboring states. For example, Indiana had a jobless rate of 3.6%.

Illinois’ poor economic performance is closely tied to the high tax rates paid by Illinois individuals and businesses. For example, the nonpartisan Tax Foundation ranks Illinois 37th among the 50 states in terms of overall state tax competitiveness. With respect to some individual taxes, Illinois is ranked even worse. For example, when taxes on motor fuel are calculated state by state, the average rate charged in Illinois ranks 49th of the 50 states, with only California charging higher taxes.

We are already more than two months into the FY26 budget cycle, which began on July 1, 2025, and will end on June 30, 2026. This budget continues our State on a pathway that has led to an increase of more than $16 billion in discretionary spending since Gov. Pritzker first took office.

House Minority Leader Tony McCombie spoke to the Center Square this week on Governor Pritzker’s Executive Order, which asked state agencies to identify up to 4% of Fiscal Year 2026 General Funds appropriations cuts.

While Governor Pritzker blamed President Trump for the State having to restrain spending, Leader McCombie had a far different view, saying “Pritzker blaming Trump and not Democratic policies impacting the economy is a smokescreen for more tax increases.”

I released the following statement after the Executive Order was announced:

“We warned that this budget was irresponsible and overspent. Stop passing blame, Governor. Illinoisans aren’t buying that recent policy changes in Washington, D.C. are to blame for the decades of Illinois financial mismanagement.”

In case you missed it, I also released the following response to Governor JB Pritzker’s mismanagement of Illinois’ Supplemental Nutrition Assistance Program (SNAP): McCombie Column: JB Pritzker’s Agency Mismanagement is Costing Illinois Taxpayers – Tony McCombie.

Illinois Needs Real Budget Transparency, Not Excuses

Governor Pritzker is blaming Washington for a crisis he created. Since taking office, he has increased state spending by roughly 40% and just signed the largest budget in Illinois history.

Transparency first. House Republicans have demanded real transparency across agencies and the budget process, including time to review billion-dollar bills and clear accounting of dedicated funds. The current process hides the ball and fails taxpayers.

Agency mismanagement. Shining a light on agencies would help fix services for Illinoisans and target funding where it actually works. Even Senator Andy Manar asked agencies on May 7, 2024 to identify $800 million in collective savings. Not a single cut was presented for public review.

The result. Illinois families were handed a $55.2 billion FY 2026 budget, about $2 billion higher than last year, along with $1 billion in tax hikes and fund sweeps. This showed little restraint and ignored the very “threat to our fiscal condition” the Governor talks about. The so-called “balanced” plan leans on fund sweeps, delayed rainy-day deposits, and cuts to priorities like education, public safety, and property tax relief.

Where to cut, starting today:

Migrant spending

○ HBIA elimination noted, but HBIS still funded at $110 million

○ $40 million for Welcome Centers, reduced from $140 million but still significant

○ $40 million for Immigration Integration

○ $35 million for immigrant services such as legal support

Pork projects

○ “Fund for Illinois’ Future,” a partisan slush fund, receives a $370 million GRF transfer and sweeps from other funds, with a $420 million balance

○ $40 million for Proviso Township High School District 209, in Speaker Welch’s district, for capital improvements and an outdoor sports complex at Proviso West

Bottom line. This crisis did not start in D.C. It is the product of years of unchecked spending, gimmicks, and a closed-door process in Springfield. House Republicans stand ready with concrete cuts and a transparent, line-by-line budget review that protects taxpayers and focuses on core services.

AGRICULTURE

Corn, soybean harvests have begun in Illinois

The U.S. Department of Agriculture (USDA), which tracks farming activities in all 50 states, reported that as of the beginning of this week, 12% of the fields planted to corn had been harvested, and 9% of the fields planted to beans had been cut. Both numbers are well ahead of the five-year average for this date.

Conditions for Illinois’ two major cash crops remain relatively good, with 56% of the corn rated as good to excellent and 52% of the beans rated as good to excellent. The same dry conditions that have brought harvesting machinery into the arable fields have, however, created challenges for owners and operators of grasslands. Only 16% of Illinois pastures are in good to excellent shape; operators that run grazing animals, especially cattle, or who harvest hay are looking for more rain to come to our state. In southern Illinois, the planting of winter wheat has begun.

On another note…If anyone is interested in joining my women agriculture advisory group, reach out to my office at [email protected]! This summer we did a tour of the John Deere Harvesting Works in East Moline:

IMMIGRATION

Protecting Our Communities: House Republicans Push to End Sanctuary State Policies

When former President Joe Biden took office, he flung the southern border of the United States wide open. During his tenure, millions of illegal immigrants poured into the country, overwhelming local, county, and state government resources and costing taxpayers billions of dollars. Out-of-control illegal immigrant crime also took hold, with horrifying examples of gang activity, carjacking, theft, assault, sexual assault, and murder dominating headlines and disrupting life for American citizens.

While the Republican caucus warned that the crisis was spiraling out of control, Governor JB Pritzker and Supermajority Democrats pretended a problem didn’t exist. The governor and his legislative allies favor an Illinois law named the TRUST Act, which encapsulates Illinois’ Sanctuary State laws. House Republicans have been sounding the alarm for years about the cost both to taxpayers and to the law enforcement community when dealing with illegal immigration and the lack of cooperation with the federal government in removing dangerous illegal criminals.

A legislative effort to repeal the dangerous and failed Sanctuary State policies of Illinois has taken root in the House Republican Caucus. Deputy Republican Leader Norine Hammond calls Illinois’ Sanctuary State law “dangerous and costly and must be repealed,” pointing to billions already spent on healthcare and benefits for illegal immigrants. Assistant Republican Leader C.D. Davidsmeyer, sponsor of House Bill 1317, underscored that “Governor Pritzker’s failed sanctuary state policy has cost Illinois taxpayers billions of dollars and made our communities less safe.” Representative Mike Coffey added that “Illinois citizens are struggling to pay for healthcare while migrants receive free Cadillac coverage—this is not fair to Illinois families.”

Dangerous Rhetoric, Real Threats to Public Safety

Recent events show the crisis is not just about budgets and border numbers—it’s also about public safety. Across the country, rhetoric is turning violent.

In response, I released the following statement:

“The recent shooting at an ICE facility in Dallas—the third of its kind in Texas this year—is deeply disturbing and wholly unacceptable. Reports that the assailant engraved ‘ANTI-ICE’ on unused rounds make clear this was an ideologically motivated act. Politically motivated violence has no place in our constitutional republic. When rhetoric turns into a license to kill, the very framework of our nation is under attack.

We’ve seen tension rise here at home as well. A recent protest in Bridgeview, Illinois, came dangerously close to crossing the line. We must speak out now—before words turn into violence—to ensure that passionate debate never becomes a spark for harm. I stand firmly with law enforcement and public servants who face heightened risk every day, and I will continue to defend the rule of law and the principle that no one should ever be targeted for carrying out their duty.”

Illinois is not immune. The dangerous rhetoric we see on national headlines is echoing right here, putting ICE personnel and local law enforcement at risk. The attacks in Texas and the volatile protest in Bridgeview are a warning: if leaders stay silent, small sparks can quickly turn into dangerous fires.

House Republicans remain committed to ending sanctuary state policies, restoring cooperation with federal immigration enforcement, and protecting our communities. House Bill 1317, to repeal the TRUST Act, is ready for action and must receive a hearing and vote.

Estimates peg the total cost of illegal immigrant services provided by the State of Illinois at more than $3 billion. HB 1317 remains stuck in the infamous House Rules Committee, awaiting a public hearing and vote.

JOBS

Granite City Works: A Victory for American Steel and Working Families

By State Senator Erica Harriss and State Representative Amy Elik

Granite City has always been a steel town. Its factories and workers are the heartbeat of our community – providing strong union jobs that support families and fuel the local economy. That’s why the recent decision to continue steel slab production at Granite City Works (GCW) is more than good news – it’s a victory for the Metro East.

Earlier this month, U.S. Steel announced plans to halt slab production at GCW. The impact would have been devastating: hundreds of workers and their families thrown into uncertainty and a community shaken. We knew we had to act.

Our fight to protect these jobs has been ongoing. In 2018, President Trump visited GCW and pledged to revive American steel manufacturing—a promise that led to new tariffs on foreign steel, the return of hundreds of good-paying manufacturing jobs, and the restart of blast furnace B.

But in 2023, GCW faced another blow when primary operations were indefinitely idled. Since then, we’ve worked relentlessly, advocating by sending letters, meeting with officials, and engaging directly with company leaders to keep GCW alive.

In June, we urged President Trump to include GCW in Nippon Steel’s investment plans. When we learned in September that slab production was set to end, we doubled down and contacted Trump administration officials, explored state solutions, and rallied local stakeholders.

Thanks to the decisive intervention of U.S. Commerce Secretary Howard Lutnick using the “golden share” to hold U.S. Steel accountable, slab production will continue. Secretary Lutnick’s leadership, and his direct engagement with CEO Dave Burritt, delivered a win for our workers and our region.

This outcome proves what persistence, partnership, and community advocacy can achieve. But our work isn’t done. We remain focused on securing long-term protections for GCW and ensuring it remains a pillar of American manufacturing for years to come.

We’ve offered to meet with Secretary Lutnick to discuss these concerns. While we’re happy to travel to Washington, our invitation stands for him to visit Granite City and see firsthand the impact these decisions have on real families and the vital work being done here.

Granite City works because its people work. And together, we’ll keep fighting for every job, every family, and every future in our community.

TAXES

Property Taxes a Top Concern for Illinois Residents

Illinois has topped the list of states with the highest property taxes, which comes as no surprise to many Illinois residents. The burden has made Illinois unaffordable for too many families and particularly weighs heavily on senior citizens and working families. Illinois House Republicans have been vocal about the need for relief and have proposed legislation to bring down costs for families.

State Representative Dan Ugaste (R-Geneva) has proposed real solutions to lower property taxes. House Bill 9 is legislation crafted to set aside part of the state budget for a grant fund to be given to school districts, and in return, requiring them to lower property taxes.

“Illinois has the highest property taxes in the country, and because of that residents are fleeing to neighboring states with friendlier tax environments,” said Rep. Ugaste. “High property taxes drive out our families, businesses, and keep investment from happening. We’re strangling our economy from the inside.”

Helping Seniors Stay in Their Homes

Illinois families are not only facing higher costs at the gas pump and grocery store—they’re being squeezed by some of the highest property taxes in the nation. Seniors on fixed incomes are especially vulnerable, too often being priced out of the homes they worked their entire lives to pay off.

These are my thoughts:

Property taxes are crushing Illinois families and seniors. In May, I worked closely with a colleague across the aisle and, through genuine collaboration, we passed legislation (SB2156) in the House that will help senior citizens by raising the income eligibility level to $70,000 in 2026 and adding a cost-of-living in 2027 adjustment to keep pace with inflation. Our next step is to push the Senate to bring this bipartisan measure forward during the October Veto Session. Seniors deserve the peace of mind that comes from knowing they can afford to stay in their homes.

This bipartisan effort is a practical step toward easing the property-tax burden and keeping seniors secure and independent in the communities they helped build.

Other House Republican measures to lower property taxes include:

● HB 0009- Ugaste- Property Tax Relief

● HB 1321- Ugaste- Tax District Surplus

● HB 1746- Sosnowski- Homestead Exemption

● HB 2543- Sosnowski- Taxpayer Empowerment

● HB 3723- Sosnowski- Senior Exemption

● HB 3724- Sosnowski- General Homestead

● HB 4010- Weber- Property Tax Extensions

● HB 4011- Weber- Assessment Limit

The House Republicans will continue to advocate for proposals that would deliver property tax relief for Illinois homeowners.

Illinois Department of Revenue announces 2025 Tax Amnesty Program

The window to pay past-due State taxes will open on Wednesday, October 1, and will close on Monday, November 17. During this six-week period, Illinois taxpayers will have the opportunity to pay past-due taxes without penalties or interest. The payments of taxes due must be made in full during this time period. This tax amnesty has been declared as a result of legislation adopted by the Illinois General Assembly in May 2025.

After the tax amnesty window closes, liable taxpayers making past-due tax payments will be required to pay not only the full amount of the taxes that are due, but also the penalties and interest payments that are set forth by statute and administrative law. These may create substantial additional liabilities for past-due taxpayers. Individuals and businesses in this category are urged to consult their tax advisors for guidance.

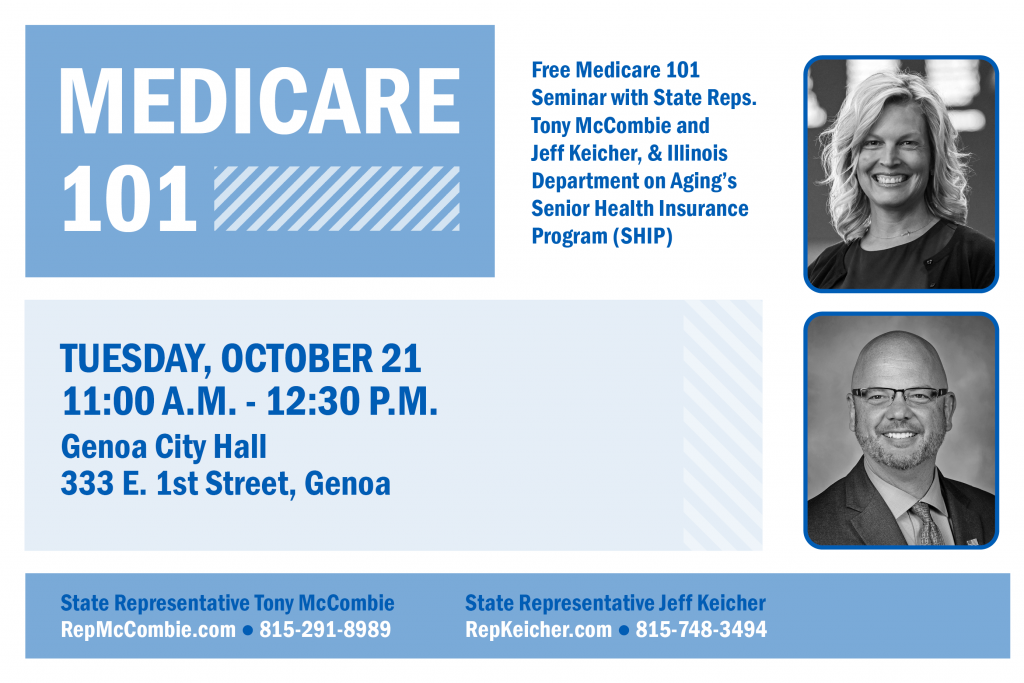

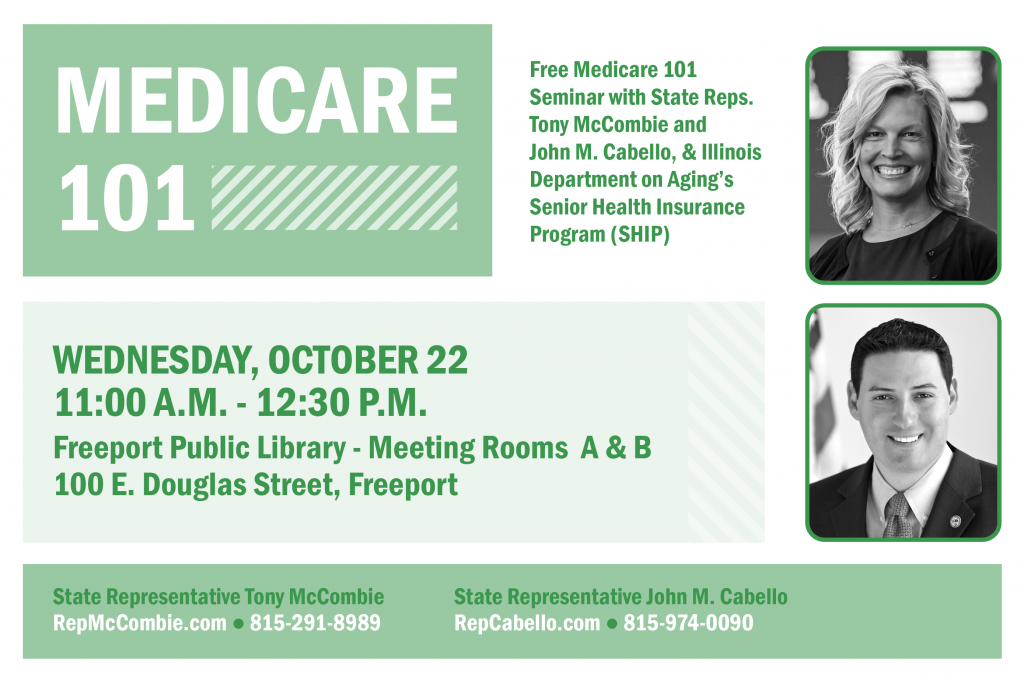

UPCOMING EVENTS

I have a number of upcoming events! Be sure to stay up to date with them on my website event’s page: Events – Tony McCombie.